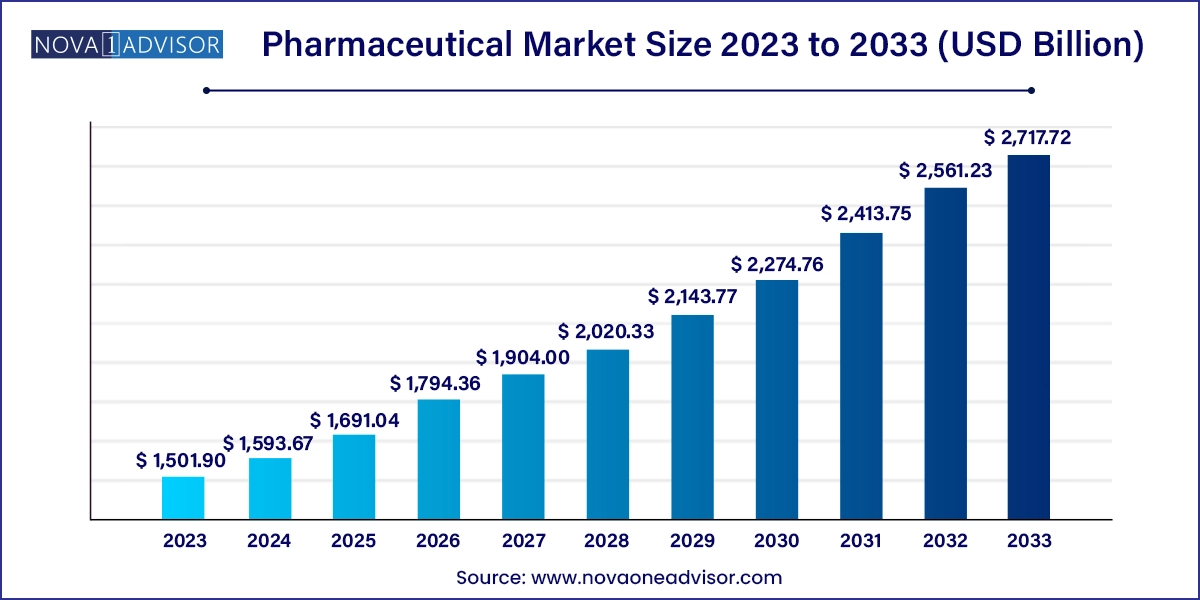

The global pharmaceutical market size was valued at USD 1,501.90 billion in 2023 and is projected to surpass around USD 2,717.72 billion by 2033, registering a CAGR of 6.11% over the forecast period of 2024 to 2033.

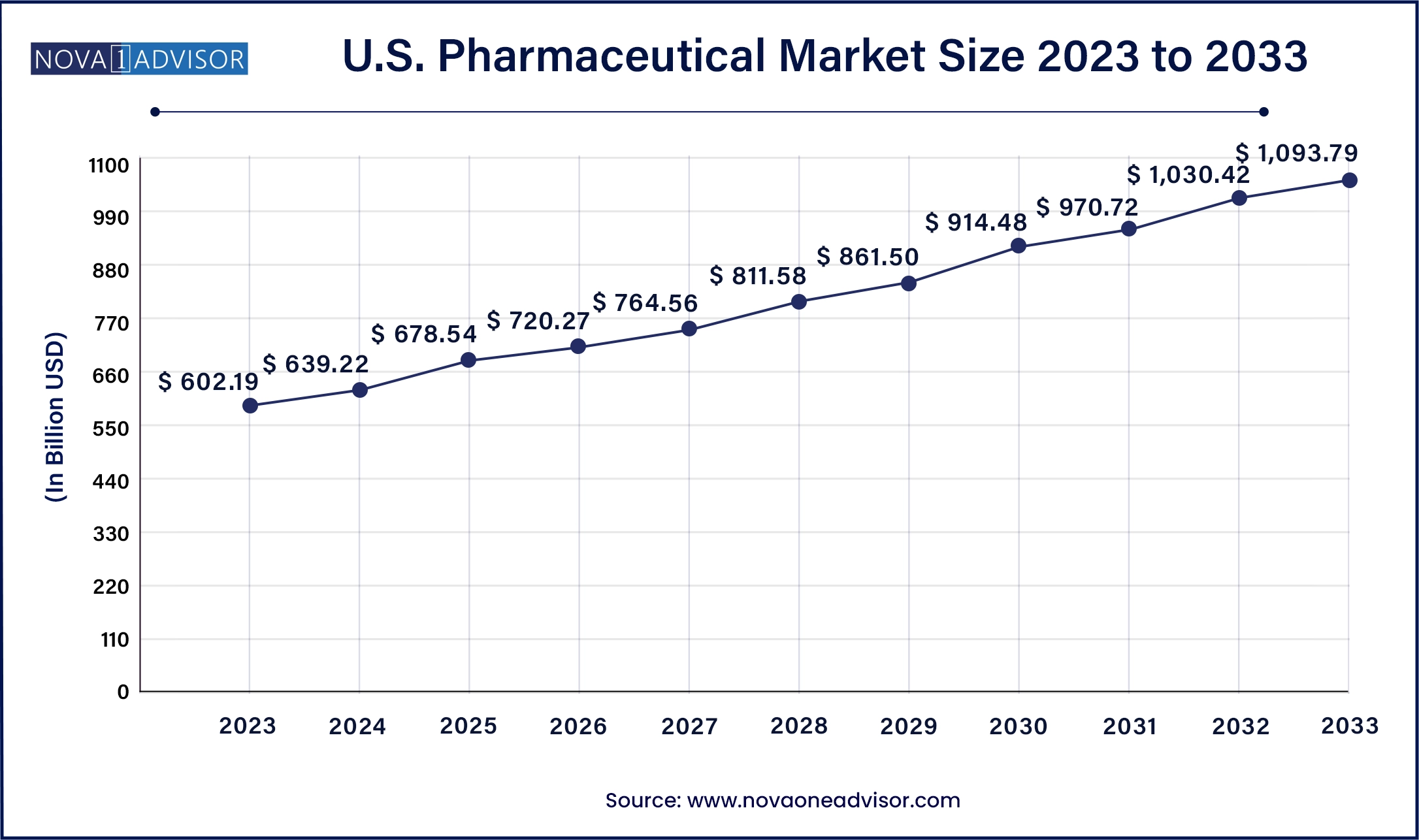

The U.S. pharmaceutical market size was exhibited at USD 602.19 billion in 2023 and is projected to be worth around USD 1,093.79 billion by 2033, poised to grow at a CAGR of 6.15% from 2024 to 2033.

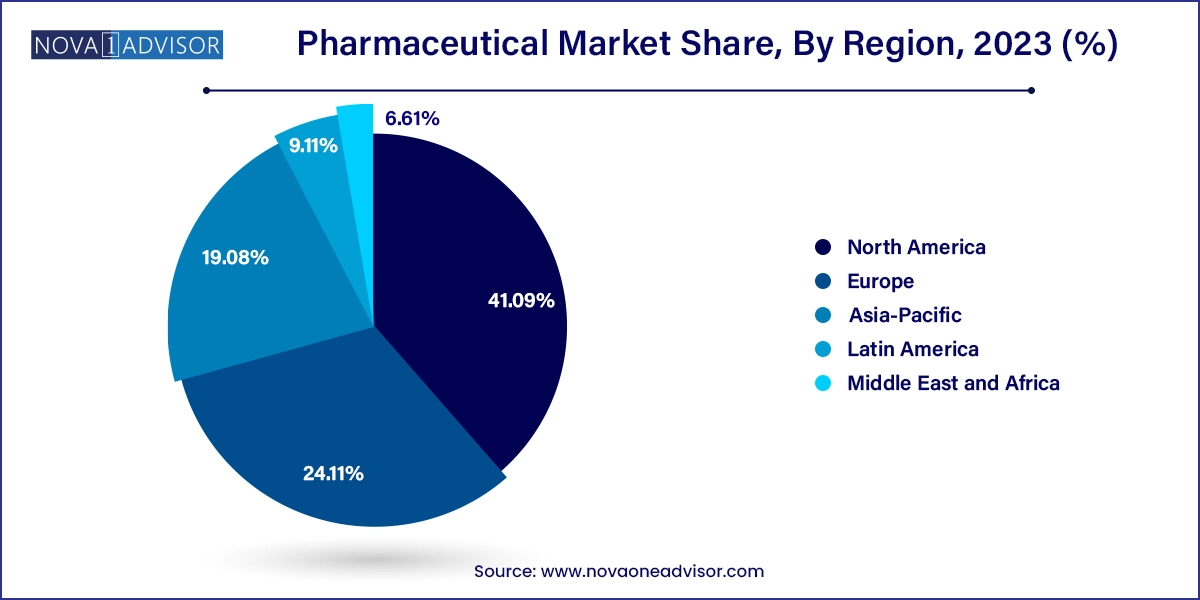

North America held the largest market share of 41.09% in the pharmaceuticals market in 2023 and is expected to maintain a dominant position, in terms of share, throughout the forecast period. Access to high-value medications, extensive healthcare knowledge, high per capita healthcare expenditure, and a strong GDP all contribute to the region's market growth. Moreover, various strategic initiatives developed in the region by established and early-stage pharmaceutical companies is another major factor propelling regional growth.

Asia Pacific is estimated to showcase the fastest growth over the forecast period. The growth of the pharmaceuticals market in the region is attributed to the rising geriatric population, along with an increasing rate of research for the introduction and development of novel therapeutics. The regional demographics are diverse, with the presence of Japan, South Korea, Taiwan, Singapore, and Australia as established countries, while Thailand, Indonesia, Malaysia, Vietnam, Bangladesh, and the Philippines, as well as China and India, present as fast-growing economies.

The global pharmaceutical market stands as one of the most critical pillars of the healthcare industry, driving innovation, enhancing patient outcomes, and shaping the future of medicine. Valued at over a trillion dollars, this market spans an enormous range of therapeutic areas, technologies, and demographic needs. With its expansive impact on economies and societies, the pharmaceutical sector encompasses everything from life-saving cancer therapies and vaccines to over-the-counter (OTC) analgesics and nutritional supplements. It forms the backbone of modern medicine, continuously evolving to respond to emerging health threats, chronic disease prevalence, and advancements in drug development.

The 21st century has seen a seismic shift in the market’s structure from traditional chemical-based drugs to biologics, biosimilars, and personalized medicine. A major contributing factor is the growing emphasis on targeted treatments such as monoclonal antibodies, cell and gene therapies, and immunotherapies. Additionally, the pharmaceutical market is adapting rapidly to changes in global health priorities, spurred by pandemics like COVID-19 and increasing cases of non-communicable diseases (NCDs). Pharmaceutical companies, research organizations, and regulatory bodies are increasingly collaborating to speed up innovation, improve affordability, and enhance global access to medications.

In a market characterized by rising R&D investments, stringent regulatory frameworks, and shifting geopolitical influences, strategic agility and innovation remain central to sustained success. The pharmaceutical ecosystem now integrates digital tools, artificial intelligence, and data analytics to accelerate drug discovery and optimize clinical trials. As healthcare systems around the world move toward value-based models, pharmaceutical companies are under growing pressure to deliver cost-effective, high-impact solutions. This landscape offers immense opportunities yet demands careful navigation of complex challenges.

Shift Toward Biologics and Biosimilars: The pharmaceutical landscape is experiencing a pivot from small-molecule drugs to large-molecule biologics, including monoclonal antibodies, gene therapies, and biosimilars.

Rise of Personalized and Precision Medicine: Tailored therapies based on genetic, lifestyle, and environmental factors are transforming treatment pathways, especially in oncology and rare diseases.

Expanding Digital Health Ecosystem: Integration of AI in drug discovery, telehealth collaborations, and digital therapeutics are becoming crucial in pharmaceutical R&D and commercialization.

Outsourcing of Drug Development: Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) are increasingly utilized to speed up development cycles and reduce costs.

Growth in Self-Administration and At-Home Care: Innovations in drug delivery formats (injectable pens, patches, inhalers) are promoting self-care, reducing hospital dependency.

Focus on Sustainable Manufacturing: Eco-friendly packaging, green chemistry, and carbon-neutral operations are becoming differentiators for pharmaceutical manufacturers.

Regulatory Fast-Tracking for Breakthrough Drugs: Governments and regulatory bodies are increasingly adopting fast-track designations, conditional approvals, and emergency use authorizations to expedite access to innovative treatments.

Pharmaceutical Market Report Scope

| Report Attribute | |

| Market Size in 2024 | USD 1,593.67 Billion |

| Market Size by 2033 | USD 2,717.72 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.11% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Molecule type, product, type, disease, route of administration, formulation, age group, end market, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd.; Novartis AG; AbbVie Inc.; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Pfizer Inc.; Bristol-Myers Squibb Company; Sanofi; GSK plc; Takeda Pharmaceutical Company Limited |

A major driving force behind the growth of the pharmaceutical market is the rising global prevalence of chronic and lifestyle diseases, including cardiovascular disorders, diabetes, cancer, and respiratory conditions. These diseases account for the majority of deaths worldwide and significantly burden healthcare systems. With the World Health Organization (WHO) reporting that NCDs are responsible for 71% of all global deaths, the demand for long-term therapeutic management has surged, fueling the pharmaceutical industry’s growth.

In developed regions like North America and Europe, aging populations have increased the demand for cardiovascular and neurological medications. Meanwhile, developing nations in Asia-Pacific and Latin America are facing a double burden—grappling with infectious diseases alongside a surge in obesity, diabetes, and hypertension. This trend has led pharmaceutical companies to diversify product pipelines and focus on long-term treatment regimens, combination therapies, and improved compliance solutions such as sustained-release formulations.

Despite robust growth, the pharmaceutical industry faces a substantial hurdle in the form of regulatory challenges and escalating R&D costs. Developing a new drug, from discovery through approval, can take over a decade and cost upwards of $2 billion. Stringent regulatory requirements though vital for patient safety can delay time-to-market and increase risk, especially for smaller players with limited resources.

Each country imposes its own standards and review timelines, making global market entry a costly and time-consuming endeavor. The FDA (U.S.), EMA (Europe), PMDA (Japan), and other national bodies maintain differing criteria for clinical trials, safety, labeling, and pharmacovigilance. Additionally, late-stage trial failures, patent cliffs, and increasing scrutiny over drug pricing amplify the pressure. For companies seeking global expansion, harmonizing compliance strategies while maintaining operational efficiency is a constant balancing act.

A transformative opportunity in the pharmaceutical market lies in the accelerated development and adoption of biologics and gene-based therapies. Unlike conventional small-molecule drugs that treat symptoms, biologics offer the potential to alter disease progression, and gene therapies aim to provide cures by correcting genetic defects. Monoclonal antibodies, CAR-T cell therapies, and RNA-based therapeutics are revolutionizing the treatment of cancers, autoimmune diseases, and rare genetic conditions.

With over 1,000 gene and cell therapy candidates currently in the pipeline globally, pharmaceutical companies are investing heavily in biotechnological innovation. The U.S. FDA approved its first CRISPR-based therapy in late 2023, opening doors for targeted treatments previously considered incurable. Additionally, biosimilars—lower-cost versions of biologics are expanding patient access while reducing strain on public health budgets. This biologics-driven paradigm shift offers massive market potential, especially when supported by favorable regulatory pathways and public-private collaborations.

Conventional drugs (small molecules) dominated the pharmaceutical market, accounting for the largest revenue share due to their wide therapeutic applicability, ease of manufacturing, and affordability. Small-molecule drugs are preferred for oral administration and continue to lead in therapeutic areas like cardiovascular diseases, diabetes, gastrointestinal disorders, and infectious diseases. Their longer market presence and well-established regulatory frameworks make them a mainstay in formulary lists worldwide.

However, biologics and biosimilars represent the fastest-growing segment, propelled by the demand for advanced therapies in oncology, immunology, and rare diseases. Monoclonal antibodies, in particular, have shown tremendous success in treating cancers and autoimmune conditions such as rheumatoid arthritis and multiple sclerosis. The growth in biosimilars is also noteworthy, especially post-patent expiration of blockbuster biologics like Humira and Enbrel, leading to broader access and reduced healthcare costs.

Branded pharmaceuticals continue to dominate the market due to their innovation-driven development, strong intellectual property protection, and targeted marketing efforts. These drugs often command premium pricing and cater to niche therapeutic areas with unmet needs. Multinational pharmaceutical giants invest heavily in R&D to bring novel compounds to market, with examples like Pfizer’s Paxlovid (antiviral) and Novartis’ Entresto (heart failure treatment) illustrating the commercial success of branded drugs.

Generic pharmaceuticals, however, are the fastest-growing segment, especially in developing economies and cost-sensitive healthcare systems. With increasing patent expirations and emphasis on healthcare affordability, generics are being aggressively adopted across public and private sectors. Moreover, regulatory bodies such as the U.S. FDA and India's CDSCO are streamlining generic drug approvals, enabling faster market entry and broader drug availability.

Prescription drugs hold the largest share of the pharmaceutical market, reflecting their use in managing chronic, complex, and severe diseases that require medical supervision. These include drugs for cancer, HIV, autoimmune disorders, and cardiovascular conditions. Prescription drugs are extensively regulated and often part of government reimbursement schemes or insurance plans, making them a cornerstone of formal healthcare systems.

Meanwhile, Over-the-Counter (OTC) drugs are expanding rapidly, driven by self-medication trends, wellness awareness, and the popularity of non-prescription options for pain relief, allergies, digestive health, and cold/flu symptoms. E-commerce, telehealth, and retail pharmacy chains are further supporting OTC distribution and consumer engagement.

Cardiovascular diseases emerged as the leading therapeutic area, owing to their high prevalence, particularly in aging populations. Statins, antihypertensives, anticoagulants, and heart failure therapies dominate prescriptions globally. These drugs often require lifelong administration, generating consistent demand.

Cancer treatment drugs represent the fastest-growing disease segment, fueled by rising incidence, advanced diagnostics, and personalized medicine breakthroughs. Immunotherapies, kinase inhibitors, and hormone therapies are reshaping oncology care, with biologics leading the innovation curve. Other rapidly growing areas include mental health, autoimmune conditions, and rare diseases where unmet clinical needs remain high.

Oral administration dominates the market, thanks to its convenience, patient compliance, and widespread use in outpatient and chronic care. Tablets and capsules are particularly favored for both branded and generic therapies.

However, parenteral routes especially intravenous and intramuscular are growing quickly, particularly in hospital settings and specialty treatments. Injectable biologics, emergency care drugs, and therapies requiring controlled bioavailability rely on parenteral delivery. Innovations in self-injection devices and extended-release injectables are further boosting growth in this segment.

Tablets continue to dominate the pharmaceutical formulation segment, due to ease of storage, manufacturing, and consumption. They are preferred for oral drugs across most therapeutic classes.

Injectables are the fastest-growing formulation, especially for biologics, emergency drugs, and vaccines. The COVID-19 pandemic demonstrated the scalability of injectables, and similar technologies are now being applied to mRNA vaccines, gene therapies, and monoclonal antibodies.

Hospitals dominate the pharmaceutical end market, especially for acute treatments, injectables, and complex biologics. Hospitals also lead in clinical trials, emergency care, and high-risk treatments like oncology and ICU care.

Clinics and other ambulatory care centers are growing quickly, owing to decentralized healthcare models and the push for community-based services. Telemedicine, home delivery of medications, and retail health clinics are further expanding this end-market landscape.

Adults constitute the largest age group served by pharmaceutical products, as the majority of chronic and lifestyle diseases manifest during this stage. This age group requires both acute and long-term medication across various conditions.

Geriatric patients represent the fastest-growing segment, given the rise in life expectancy and age-related disorders such as Alzheimer’s, arthritis, and osteoporosis. Polypharmacy use of multiple medications is common in this group, generating substantial demand for chronic medications and drug safety innovations.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Pharmaceutical market.

By Pharmaceutical Molecule Type

By Pharmaceutical Product

By Pharmaceutical Type

By Pharmaceutical Disease

By Pharmaceutical Route of Administration

By Pharmaceutical Formulation

By Pharmaceutical Age Group

By Pharmaceutical End Market

By Region